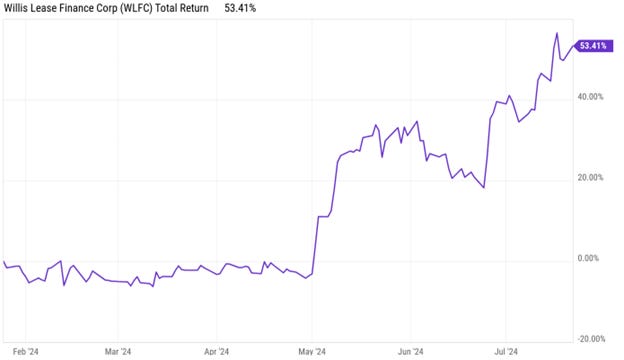

January 25, 2024

WLFC’s primary business is leasing spare aircraft engines to airlines. They own around 350 engines. Tangible book value per share is about $67, but there is a lot more value if you fair value the balance sheet assets. The engines are carried at the lower of appraised value or depreciated value. Most are carried at depreciated value. However, an engine typically rises in value in the first three to five years. With the current inflationary environment the values are even worth more today than historically. Backing into the market value based on the values disclosed in their asset backed securities, there is at least $60 per share of value not reflected in book value related to the fair value of the engines.

WLFC is positioned well for the current rate environment. They have legacy asset-backed security issuance that has an all in cost of around 4%. The did another this past month that is about 8% cost, which will take overall funding up some.

The management owns about 57% of the company and has tried to take it private three times, but hasn’t been successful. The most recent offer was earlier this year for $50 per share but the independent committee of board members was not willing to accept the inadequate price. The negative is management compensation is way too high and unnecessary expenses (use of corporate aircraft, yacht, etc.) are a drag on earnings, but shares are inexpensive enough to still make this a great investment. There are multiple routes to getting capital returned: they could do a modified Dutch tender (they have done two before), a capital distribution/special dividend, a sale of the company, or another attempt to take it private.

February 26, 2024

Willis Lease (WLFC) is a late reporter but the larger aircraft leasing companies put out robust fourth quarter results. WLFC probably will too.

March 22, 2024

Willis Lease (WLFC) earned $1.53. After adjusting for an abnormal tax rate and elevated expenses (apparently related to potential Russia recovery) the company is starting to show annual earnings power of $8 to $10 per share with a book value up to about $58.

May 9, 2024

While they report it as about $69 per share, Willis Lease (WLFC) has a fully adjusted book value of well over $100 per share and many opportunities to improve value. Later this year, it is reasonable to expect a significant settlement with the insurers on engines lost in Russia. They have low yielding fixed-rate debt that would show a significant gain if they retire it. Their SG&A is too high but trending in the right direction at about $30 million this past quarter down from $39 million the previous quarter. Their return on tangible common equity is about 18%. Management has made multiple low-ball offers to buy the company in the past at price/stated book ratios that would equate to offers at today’s book value of $49, $55, and $75 per share. They have $400 million in value in engines that they don’t reflect in their stated book value.

I already knew the content of this slide (a big part of the earlier investment thesis) but it is still interesting in and of itself. Management has gone from obfuscating this value to presenting it. They are on track to make $10 per year. A reasonable 8x multiple gets to $80 per share, which is still a deep discount to its real book value when one includes the now disclosed engine value. As management gets this story out, the price will probably begin to converge on that price.

July 23, 2024

July’s update will be out shortly with updated thoughts on WLFC’s value and catalysts.